A series of legal judgments in recent years have shaped the landscape of modern trust management and administration. These cases shed light on the approach taken by courts regarding passive trusts and set precedents with global implications, ultimately calling attention to such structures where settlors exercise an excessive degree of control. The Foundation-Trust structure was developed with these cases in mind allowing a client to have some degree of control, whilst at the same time protecting the integrity of the trust.

Case 1: Mezhprom Bank vs. Pugachev (2017)

Russian oligarch Pugachev, residing in London, established five New Zealand trusts worth a substantial amount.

Pugachev founded Mezhprom Bank in Russia in 1992. In late 2010, the bank went into liquidation. The bank was declared bankrupt and the Russian Court ruled personally against Pugachev for the sum of US$1bn.

While these trusts were initially perceived as legitimate, Pugachev had maintained extensive powers within the trusts, leading to the conclusion that he never intended to relinquish control over the assets. These trusts, in essence, were a facade, allowing creditors to enforce their claims effectively.

Key Findings

- Pugachev was considered the ultimate beneficial owner of the trusts, despite his son holding key roles within them.

- Pugachev possessed significant powers, including directing the sale of residential property.

- The protector’s powers, while not fiduciary, enabled Pugachev to maintain control of the assets.

- The power of removal of trustees “with or without cause” was criticized for lacking limitations.

- The court prioritized the substance of the trusts over their form, revealing Pugachev’s true intention of retaining control.

- The director of the New Zealand corporate trustee faced criticism for lacking knowledge about trust assets.

Case 2: Webb v Webb (2020)

Two domestic Cook Islands trusts were established by a settlor who occupied multiple roles within the trusts and was the sole trustee as well as the protector and a beneficiary. He was authorised to distribute the entire trust fund to himself if he wished.

The Court ruled that the trusts were invalid due to the extent of the powers over the trust fund that the settlor had reserved to himself. The trust assets were therefore available to satisfy a matrimonial property claim against the settlor.

Key Findings

- The settlor had arranged matters in such a way that he held the trust fund on trust for himself and no-one else.

- All legal and beneficial interest in the trust fund was vested in the settlor, whose rights were indistinguishable from those of ownership.

- The establishment of the trusts had failed to record an effective alienation by the settlor of any part of the trust fund.

Case 3: La Dolce Vita Fine Dining v Zhang Lan (2022)

Settlor established a Cook Islands trust with an underlying company holding of which she was director and sole signatory. She was also the sole signatory on bank accounts held by the company and could transfer funds to and from those accounts as she wished.

The trust agreement described the trust as irrevocable and stated that the settlor was excluded from benefit and had no rights under the trust.

Settlor transferred US$142m of her own funds to company bank accounts without knowledge or consent of trustee. She subsequently managed used those funds for her own benefit, again without trustee knowledge.

Singapore High Court ruled in enforcement proceedings that the settlor was the beneficial owner of the company’s bank accounts and that receivers could be appointed to manage the accounts for the benefit of her judgment creditors.

Key Findings

- The settlor had not created a genuine trust as she had not intended to do so, having failed to relinquish control of the assets in the trust fund.

- Regardless of the wording of the trust agreement, the settlor had conducted herself as if the assets in the bank accounts were her personal property. She retained ownership and control of those assets, which were not managed in accordance with the trust agreement.

- The trust structure afforded the settlor no protection from her creditors, who were able to look through the trust structure and access the trust property.

The Foundation-Trust Structure:

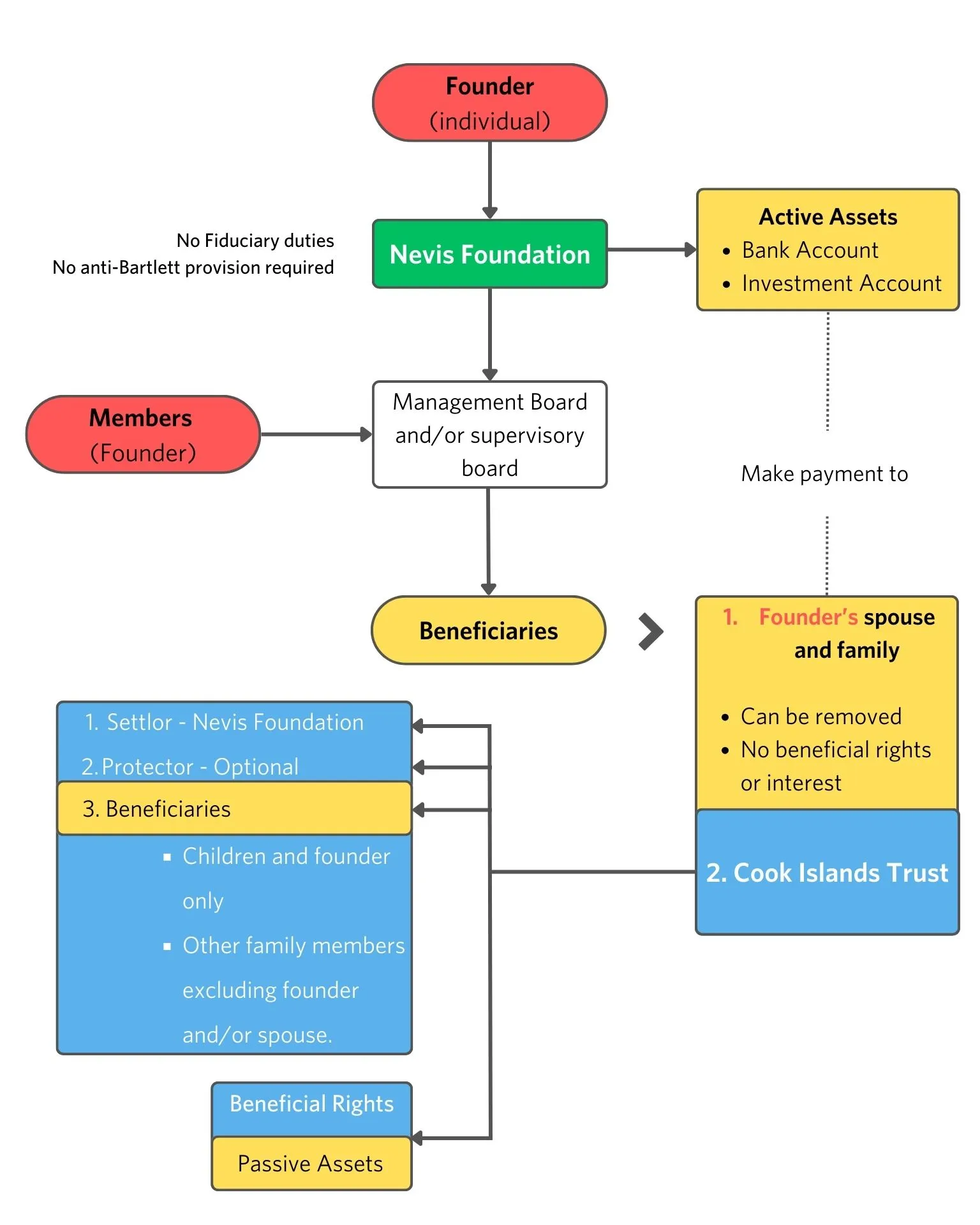

With these legal developments in mind, a structure combining a Nevis foundation with a Cook Islands trust has been developed. This structure allows clients some control while safeguarding trust integrity. The Nevis foundation acts as the holding or trading entity for assets, and the Cook Islands trust is a beneficiary. This structure balances control and security within the evolving legal landscape.

The Foundation-Trust structure provides a unique approach that enables clients to maintain a level of control beyond that permitted in standalone trust structures. In this structure:

Nevis Foundation as the Hub: The Nevis foundation serves as the central holding or trading entity for assets. It combines characteristics of both a trust and a company, operating like a company but without shareholders. The foundation must have a purpose and may also have beneficiaries who have no beneficial rights as they would in a trust so can be removed at any time for no reason. While the foundation management board has fiduciary duties towards the foundation, neither the foundation nor the management board has fiduciary duties towards the foundation beneficiaries. The foundation can therefore be managed and administered without the burden of fiduciary obligations, allowing clients to maintain additional control.

Cook Islands Trust as the Beneficiary: A Cook Islands trust can be established to assume the role of a beneficiary of the Nevis foundation. The foundation should make periodic distributions to the trust as its beneficiary, ensuring additional asset protection and security. If necessary in the event of duress, the foundation can remove the trust as a beneficiary, providing an added layer of protection and severing the trust from its ties with the foundation.

In practice, the Foundation-Trust structure operates as below:

The cases referred to above emphasize courts’ decreased tolerance for passive trust management where settlors retain total effective control over trust assets and manage them without the involvement of the trustee. The Foundation-Trust structure provides a viable solution in this landscape, offering clients a means to legitimately maintain control through a foundation while being able to access additional layers of protection through an offshore trust.

If you are interested in finding out more about how a Foundation-Trust structure may provide you with additional protection and control, please reach out to your regular Southpac point of contact or contact us.

Disclaimer: the above contains the opinion of the author and is for information purposes only. It is not intended to constitute legal or tax advice. If you are considering establishing or modifying an offshore structure, please consult with legal and tax professionals in your jurisdictions of residence, domicile and tax residence beforehand.